SpotLab: our Market Data Management Solution

In this era of Data Science, setting up a shared market data repository has become crucial. The purpose is to automate data retrieval from data providers, automate data controls, trace applied fixes and rationalize their distribution to the various types of consumers. Our SpotLab solution offers a turnkey generic database for developing complex repositories.

SpotLab is our MySQL-based software solution that allows you to quickly build a market repository tailored to the needs of asset managers using a database schema and a set of preset features. It includes administration software allowing you to manage the repository, connect to the various data providers and execute the data verification and correction algorithms. The software also offers data query and viewing features.

Points Clés :

- MySQL RDBMS

- Cloud or local hosting

- Multi-user

- Multi-asset

- Multi data providers

- Multi symbology

- Timebars & fundamental data

- Automatic updating

- Data auditing

Typology

SpotLab can store historical timebars and statistical data calculated by data providers at different resolutions (day, 10 min, 5 min, 1 min) for the main instruments negotiated on electronic markets, mutual funds, rate curves, and implied volatility surfaces. The characteristics of the instruments and their symbols used with the various providers are also recorded. The software can also be used to create Equity Baskets and sets of Futures that facilitate generation of generic and synthetic contracts.

Multi-Asset :

- Equities

- ETF

- Bonds

- Futures

- Listed options

- Mutual funds

- FX Spot

- Rate curves

- Volatility surfaces

Feed Handlers

With its connector-based open architecture, SpotLab allows automated updating of historical market data via a point-to-point Internet connection. Instruments can be updated by several providers, improving data reliability by comparing them with several sources.

Multi Providers :

- Bloomberg

- Refinitiv

- Funds360

- OpenFIGI

Distribution

The data stored can be queried in SQL with MySQL native drivers (JDBC, .NET, ODBC, etc.), Java and Python APIs offering a high level of abstraction, or in HTTP via a dedicated REST web service. These multiple connectors allow proprietary and standard applications (Excel, MATLAB, GAUSS) to access the data repository directly without requiring a tedious exchange of text files.

Multi-Canal :

- Native MySQL drivers

- PHP

- Java and Python APIs

- HTTP (REST service)

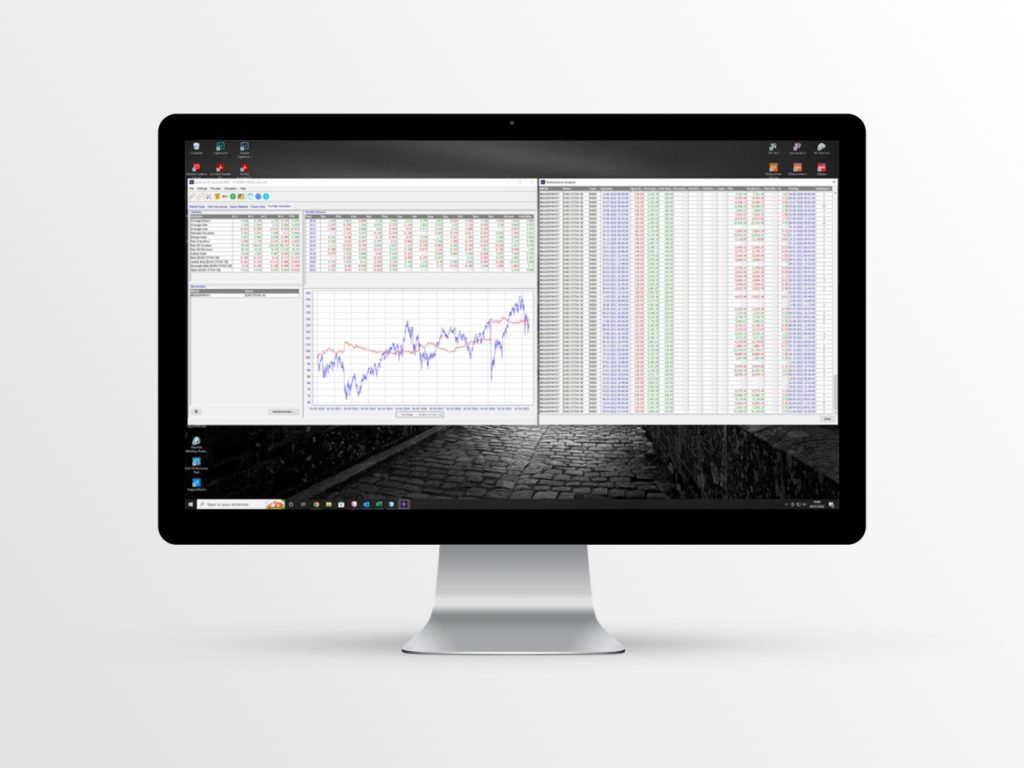

Fully automated portfolio management can be programmed with the Java API SpotAPI and executed as an historical simulation. The same Java executable (a JAR) can then be executed via “live trading” or “shadow portfolio” with the execution robot integrated in the PMS/OMS SpotTrader.

Automated Portfolio Management:

- Java language

- Dedicated API

- Historical simulation

- Performance attribution

- P&L analysis

- Transaction analysis